As we approach the end of the 2024 financial year, it’s essential that you understand all BGL-recent Simple Fund 360 and Simple Invest 360 updates. This knowledge will help you prepare for tax time and ensure your clients are ready for lodging. The changes outlined below are significant and require your immediate attention.

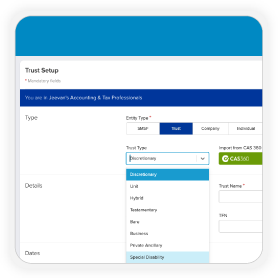

Changes to SMSF, Trust, and Company Tax Returns will take place on 1 July 2024 as part of the ATO’s Modernisation of Trust Administration Systems (MTAS) project. These changes affect lodgements for the 2023–24 income year onwards and include:

- Labels in the statement of distribution, which forms part of the Trust Tax Return, have been modified to improve the reporting of beneficiary details.

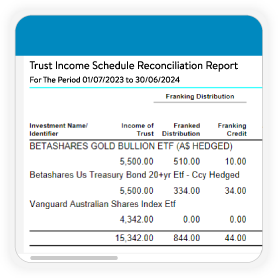

- All trust beneficiary types (including SMSFs) who receive trust income must now lodge a new Trust Income Schedule with their SMSF, Trust and Company Tax Returns.

Simple Fund 360 and Simple Invest 360 have been updated to accommodate these changes. Follow the links below for more information:

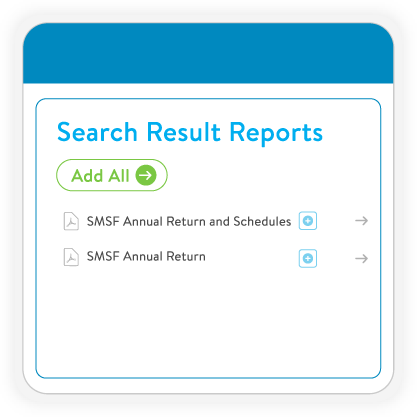

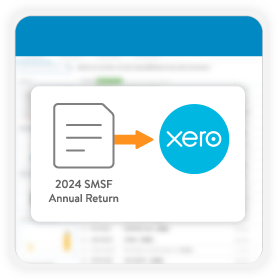

The good news is that the ATO did not change the 2024 SMSF Annual Return this year.

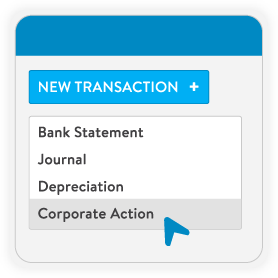

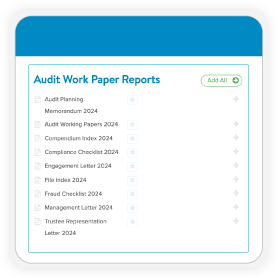

BGL released an update to Simple Fund 360 on 30 May 2024 to support the new return, including for funds that have been wound up. The new Trust Income Schedule was also included in this release and will affect many SMSFs. Learn More

The SMSF Annual Return can be lodged using Simple Fund 360, or if your firm uses Xero Tax, you can send it directly to Xero for lodgement.

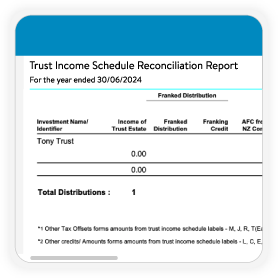

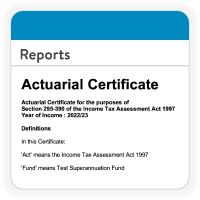

From the 2024 income year, if an SMSF receives one or more distributions from trusts, including (ETFs, Managed Funds, & Stapled Securities), you must complete and attach a Trust Income Schedule to the SMSF Annual Return.

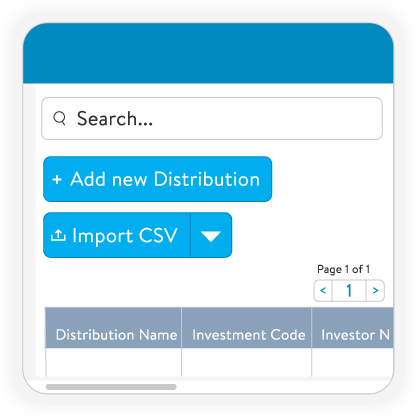

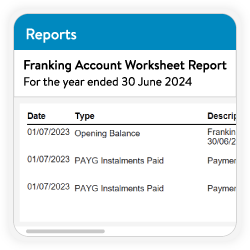

The ATO expects any investment with trust income recorded in the SMSF Annual Return at item 11 Income – labels A, D, M or U2 to complete a Trust Income Schedule. After Creating Entries for the 2024 Financial Year, Simple Fund 360 will automatically create a schedule for each investment that receives a distribution during the financial year. Learn More

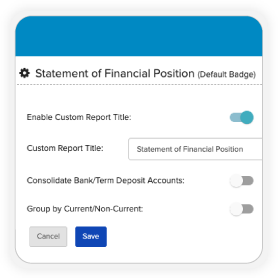

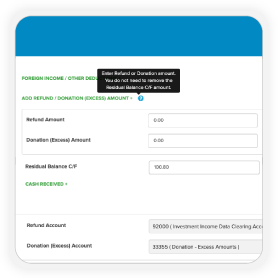

The 2024 Trust Tax Return in the Statement of Distribution section has 6 additional Capital Gains labels to match the new Trust Income Schedule. New fields have also been added for the small business energy incentive.

From the 2024 income year, if you received one or more distributions from trusts, you must complete a Trust Income Schedule and attach it to the tax return. This will be automatically populated by Simple Invest 360 as part of the year-end process.

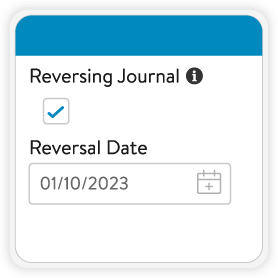

As part of the year-end process, Simple Invest 360 allows you to automatically post inter-entity journals where a group has multiple trusts. This will help avoid data duplication and ensure the accuracy of Tax Components. Learn More

What is Simple Invest 360?

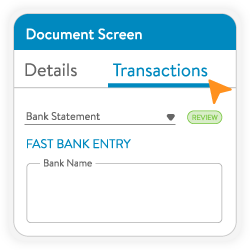

Simple Invest 360 is the complete accounting, investment and tax solution for non-SMSF entities – taking you from bank transaction feed data to tax return lodgement with everything in between! Leveraging BGL’s advanced AI technology, Simple Invest 360 can also automatically extract data from bank statements, rental statements, property settlement statements and annual tax statements to match transactions to the ledger.

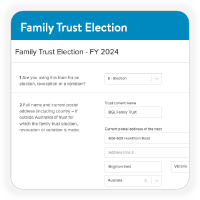

A Family Trust Election form can now be created and lodged via Simple Invest 360 for Trusts. Learn More

The 2024 Company Tax Return has new fields to cater to the small business energy incentive and Digital Games tax offset.

From the 2024 income year, if you received one or more distributions from trusts, you must complete a Trust Income Schedule and attach it to the tax return. This will be automatically populated by Simple Invest 360 as part of the year-end process. Learn More

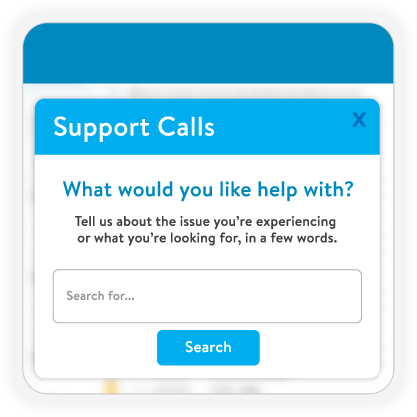

Later this year, BGL will import Due Dates for all entities directly from the ATO and you will be able to lodge Return Not Necessary (RNN) Forms.

Recent Comments