We’re excited to share another Simple Fund 360 and Simple Invest 360 update!

What's New?

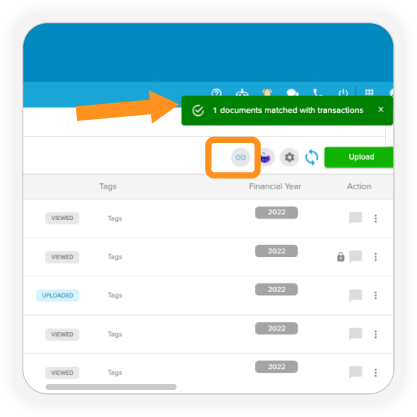

Document Re-sync

In Simple Fund 360 and Simple Invest 360, documents are automatically attached when you allocate or update transactions using previously uploaded files. To reprocess all documents, go to the Documents screen and click Re-sync to link any matching transactions instantly. Learn More

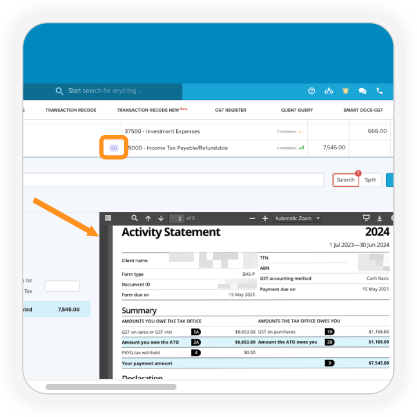

BGL SmartDocs

ATO BAS Statements will now be automatically identified and previewed in Smart Matching whenever relevant transactions are detected. Learn More

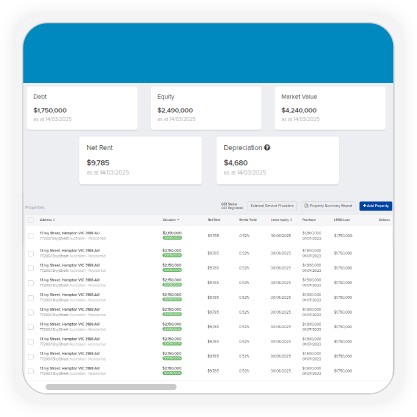

Property Dashboard

Manage all properties at the entity or firm level with the new Property Dashboard. View expenses, income, valuations, net rent and related documents in one place. Additionally, store lease details and order property valuations seamlessly. Learn More

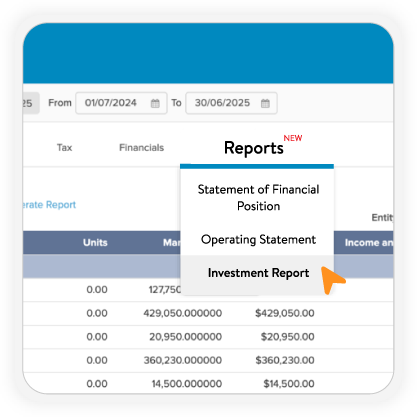

New Report

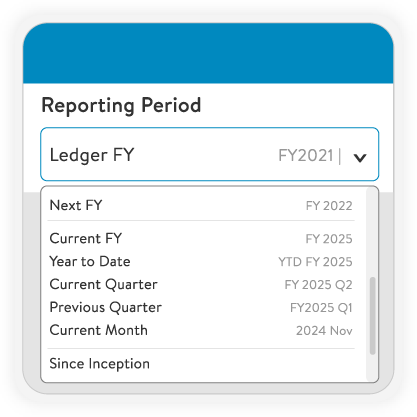

Asset Allocation by Investment Account report displays investments in a pie chart based on the control account. Learn More

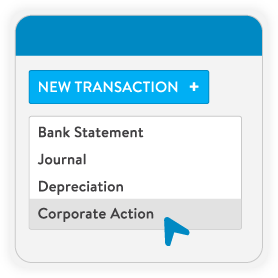

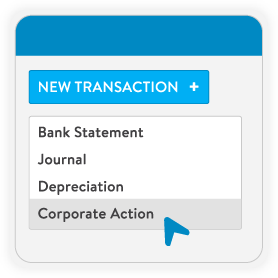

Corporate Actions

5 new mergers have been added to Corporate Actions:

- MKG: 6 February 2025

- ABA: 19 February 2025

- POS: 19 February 2025

- MWY: 18 February 2025

- EBG: 16 February 2025

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

GM – Product

E: JTokhi@bglcorp.com.au | P: 1300 654 401

Connect with me on LinkedIn

Recent Comments