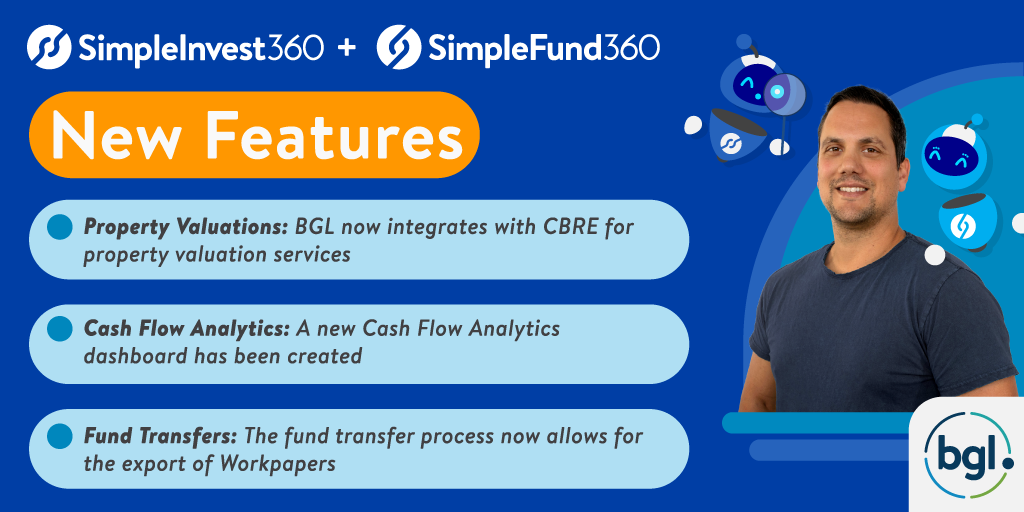

We’re excited to share another exciting Simple Fund 360 and Simple Invest 360 update!

What's New?

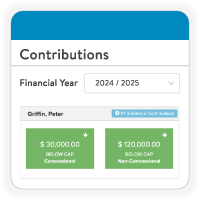

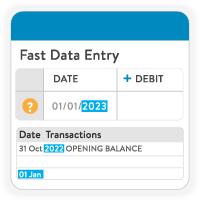

Member – Contributions

The Contribution Dashboards and Reports have been updated to reflect the increase in the concessional and non-concessional contribution caps effective from 1 July 2024. Learn More

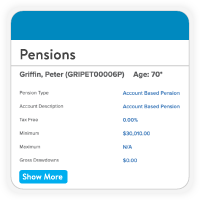

Member – Pensions

The minimum pension payment factors have been adjusted for the 2024-25 financial year in Dashboards and Reports. Learn More

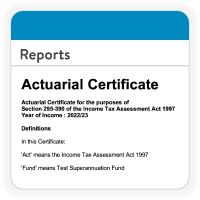

Fund Pension Policies – Reports

The Actuary Certificate received on the Fund Pension Policies screen can now be selected on the Reports screen for inclusion in report packs. Learn More

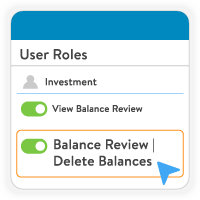

Firm Management – User Roles

A new authority has been added under the ‘Investment’ section, allowing non-admin users to delete balance records in the Balance Review screen. Learn More

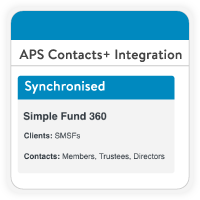

Practice Management Integration – APS Contacts+

The BGL Suite and APS Contacts+ integration is now live. This two-way integration allows for efficient client and contact data management across four apps (CAS 360, Simple Fund 360, Simple Invest 360 and APS Practice Management) in a single database. Learn More

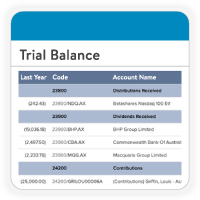

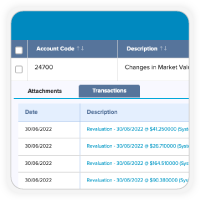

Smart Matching – Account View

The Account View for each sub-level account will now be collapsed by default, with the addition of one-click refresh and expand/collapse all buttons. Plus, debits and credits are now separated into distinct columns for a clearer view. Learn More

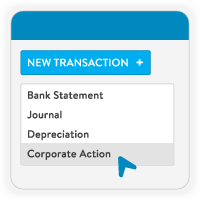

Corporate Actions

Two mergers have been added to Corporate Actions:

- DVR – 6 March 2024

- WSP – 6 March 2024

Plus, many more new features and improvements.

Stay tuned for future releases!

Jeevan Tokhi

General Manager of Product – Simple Fund 360, Simple Invest 360 and BGL SmartDocs 360

E: JTokhi@bglcorp.com.au | P: 1300 654 401

Connect with me on LinkedIn

Recent Comments