BGL is proud to announce the release of the 2020 SMSF Annual Tax Return in Simple Fund 360.

BGL is proud to announce the release of the 2020 SMSF Annual Tax Return in Simple Fund 360.

Having worked with multinational corporates, SMEs and start-ups with angel or venture capital backing, Matt brings to the BGL Team many experiences and learnings from both the product and sales perspectives. Matt will join the BGL Team as the Head of Sales and Account Management with a focus on building strong relationships with existing clients and prospects to drive sustainable growth in BGL cloud products.

“I’m thrilled to be joining BGL!” said Matt Green. “BGL has a wonderful team. They’ve worked hard to build a solid business with innovative products and enjoy very loyal customers. I look forward to helping the BGL Team build upon their successes to date”.

“Matt is a great addition to the BGL Leadership Team” says Ron Lesh, BGL’s Managing Director. “Matt has a wealth of experience in the accounting and financial services industry and with SaaS businesses. We are excited Matt has decided to join us”.

BGL has a team of over 150 people across Australia, China, Hong Kong, Philippines and Singapore.

Krish has been a BGLer for an incredible 9 years and is an essential part of the Simple Fund 360 team!

As a leader, your words matter. As a person of any influence, in whatever capacity, your words matter.

To say the least, times have been very interesting. While much of the talk has been about the virus, I want to share a few thoughts on the power of words and leadership.

At the beginning of the State of Pandemic declared in Victoria, the managing director and founder of BGL, Ron Lesh, told the team: “Your jobs are safe, look after yourselves and families, know that we will get through this and we will do all we can to support you”. In that very moment, Ron took away the impact and power of fear in a few brief words and moments.

I listened to a webinar with Jeff Immelt, ex CEO of GE, last week. He said one of the most important roles of a leader is to “absorb fear”. I add to this that true leaders personally carry the burden of fear, shielding their people from its power and potential effect. They use words that instill confidence, hope, courage and belief. Watching and listening to some of the leaders, I cannot help but express my frustration at the choice of words and language used. Phrases like “the worst is ahead”, “prepare for carnage”, “be afraid”, “thousands will die” and “our hospitals will be full” do absolutely nothing to instill a sense of hope or offer any assurance or confidence to the people. In this time, unfortunate as it may be, some leadership styles have defaulted to Leadership by Fear.

Leadership by fear is designed to make you scared. This allows the leader to control, manipulate and force desired outcomes often driven by hidden agendas. Some see this as great leadership when in fact, the exact opposite is true.

By magnifying fear and fuelling its power, we give permission for fear to take hold and define us. This fear and the continual drumming into us “what could be” is contributing to an escalation of mental health issues that will make the virus a literally a bump in the road. The virus curve is flat. The curve of concern, anxiety, insecurity, uncertainty, hopelessness and desperation is well and truly on the rise.

In a recent survey, peoples greatest concern was found to be the global economy, the local economy, a loved one contracting the virus and the person themselves getting the virus. The virus may have been No 1 at the beginning of the pandemic, but this has now changed. However, the language from some of our leaders has not. The level of fear, confusion and despair has escalated significantly. People’s ability to provide for themselves and their families is of significant concern. People need to get back to work, be engaged and have their self-esteem and confidence restored. This needs to happen sooner rather than later. This can only happen with strong positive leadership.

While I do not object to measures taken, we have done and continue to do our part, and what we want now is a plan. What we want is some encouragement, words of affirmation, positivity as well as the many positive stories and developments that give us real reason for hope and a great future. Instead, positivity rarely gets to the surface and negativity is amplified as that is what gets the people’s attention.

We need a plan to address the concerns of the people and that clearly articulates a way forward. We need to see leadership that takes people by the hand, taking each of us through to the other side of this. Countries like Austria and New Zealand have done this superbly. It’s not that hard. Instead, in this country, it has become a game of state government against state government and very evidently, state government against federal government. In this very moment we have a once in a lifetime opportunity to unite a nation (we need this more than ever before) instead we have defaulted to leadership by comparison.

Drop the comparisons, egos and agendas. Leadership is about people. That is a leader’s primary responsibility. The language and words used can either fuel hope and aspiration or hopelessness and defeat.

Leaders of this nation, please come together and make this nation great again!

“Our clients are doing it really tough” says Ron Lesh, BGL Managing Director. “They are working 16+ hour days to help their clients through the incredible complexity of the government’s COVID-19 support packages while dealing with the same financial difficulties in their own business”.

There has been much well-earned praise for our hospital workers, emergency workers, the staff at Coles and Woolworths, the many thousands of food retailers, restaurant owners and all the others battling to keep the Australian economy alive during this crisis. But nothing has been said about the incredible contribution made by those helping Australia’s 2,000,000 + small business survive the economic carnage.

“One thing New Zealand got right through their shutdown is a voucher scheme for accounting services” Lesh observed. “I see the IPA and the CPA’s have been calling for a similar scheme for Australian small businesses. It really is time the government stepped up”.

“I am also incredibly disappointed our politicians and public servants do not seem to want to share the pain and sacrifice made by so many others” added Lesh.” We really are not ALL in this together. If you are a politician or senior public servant, you seem to be in a protected class!”

“I am really concerned about the economy and the mental health of my people, our clients and their clients” said Lesh. “The rhetoric coming from the state premiers and so much of the media really does not help give Australian’s any sense of a positive future – and there is a hell of a lot to be positive about!”

“Employees want to know their jobs are secure and that there is a light at the end of the tunnel” Lesh said. “From Day 1, I went out to our people and told them their jobs are safe – focus on your health and your family. The rest will take care of itself. This period of economic vandalism will end. And you will be able to be with your mum on Mother’s Day – who would have known the Grim Reaper from Spring Street would be so cruel as to ban that!”

“I am really proud of the BGL Team” noted Lesh. “My guys have continued to release market leading software throughout this period. And our clients have continued to benefit from our first-class product support while our account managers have helped those we can.”

Published by selfmanagedsuper

Written by Jason Spits on 29 April 2020

mSmart managing director Derek Condell said while the models put forward by ASIC and Industry Super Australia (ISA) are using figures presented in real dollar terms, they have also factored in inflation until the age of retirement, which in some cases could be up to 40 years away.

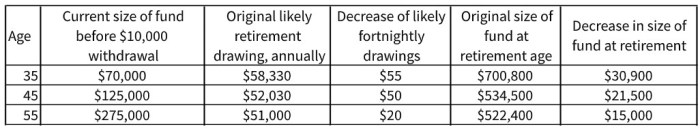

Condell said modelling conducted by mSmart, using algorithms developed by mSmart director Dr Frank Ashe and which eliminated the inflation component, found the overall decrease in a final super balance was around $30,000 for a super fund member aged 35 at the time of early access and who had an initial balance of $70,000 at that time.

He added the decrease translated to only a $55 a fortnight, or $1430 a year, drop in an original estimated pension drawdown of $58,000 and similar declines were seen for members currently aged 45 and 55 and retiring at age 67 and drawing a pension from age 68 onwards (see table below).

“We have calculated the above with a 50 per cent probability and assume that the investment portfolio is continually invested in assets despite markets having fallen from their highs, and the results are shown in today’s dollars, where we have taken inflation out to give a meaningful ‘like with like’ result,” he said.

“We have done this to show what purchasing power people would have with their superannuation if they were accessing the money today compared to what these funds may look like in 10, 20 or 30 years, and the impact is minimal.”

The firm’s numbers echo comments from a senior Treasury official who was questioned during a senate committee about the modelling used by ISA in producing its figures.

ISA released its model on 26 March and estimated fund members could face an impact on their final superannuation balance that was twice that estimated by ASIC on its Moneysmart webpage.

Responding to questioning from Senator James Paterson as to the difference in the figures, Treasury retirement income policy division head Robert Jeremenko told the the Senate Select Committee on COVID-19, which is examining the government’s response to the pandemic: “The major reason for that is the use of nominal figures rather than real figures. Those figures that ISA quote do not use today’s dollars, effectively.

“That is inconsistent with what ASIC has told super funds and what ASIC has told anyone who is making public statements about the effect on retirement balances of various withdrawals from super.

“So it makes intuitive sense to me that you use today’s dollars when you’re trying to estimate what effect a withdrawal will have at some point in the future, which is what the ASIC Moneysmart calculator does.”

mSmart recently announced it was in the final stages of developing an app that projects the likelihood of the future value of superannuation, savings pools and education funding plans, taking into account all the uncertainties of economies and markets.

SMSF trustees and self-directed investors will be able to generate accurate assessments about their future pension balances and how long retirement savings may last via a new series of apps currently under development by an investment and retirement-focused fintech firm.

BGL has been recognised for Australia’s Best Customer Service in the category of computer systems, software and internet services in the 2020 Australian Achiever Awards.

Jess has been a BGLer for an incredible 8 years and is an essential part of the Client Success team!

I hope this was as a result of lobbying by the accounting bodies.

When I last spoke to the ATO, I was told the accounting bodies supported the ATO position of asking each tax agent to apply for extensions. What changed their minds ?

I called out the previous ATO position as stupid.

It is nice to see the ATO eventually agreed!

Recent Comments