Hello everyone and welcome to 2021!

For the first release of 2021, the CAS 360 team have worked on some great new features.

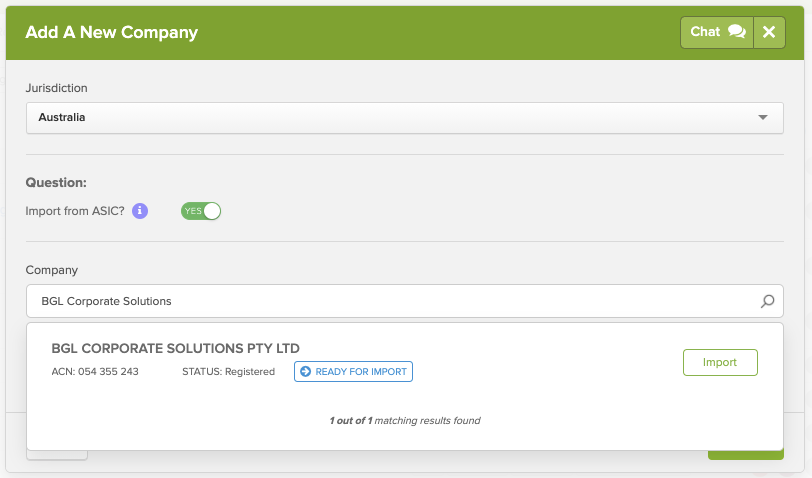

Adding a new Company

When adding a new company to CAS 360, you can now import the basic company information directly from ASIC.

If you toggle on the ‘Import from ASIC?’ CAS 360 will conduct a real time search of the ASIC register and find the company for you.

Clicking on import, will add the company to your CAS 360 company list, and also import the basic company information (Company Name, Number, Company type and class).

Trust Documents

CAS 360 is the best place to manage all of the trusts that your firm looks after, with industry leading trust features.

In this update, we add more documentation for trusts.

When preparing unitholder transactions, if there is an allotment transaction, CAS 360 will now prepare a unit allotment journal, and for unit transfers CA360 will now prepare a unit transfer journal.

New Trust registers have also been added, with a new Register of Trust Relationships, which will show all of the position holders in the trust. Also, a new Register of Trust Events has been added, which will show all event transactions that have taken place inside the trust.

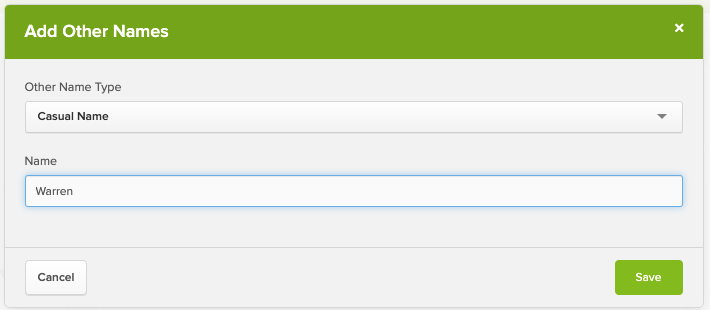

New Contacts screens

This update sees a huge change in the way contact data is entered into CAS 360. We have added new fields and grouped a number of key data fields.

We have added support for ‘Other Names’ which include ‘Casual Name’ a long time requested feature, soon this casual name will be appearing on documents such as letters.

We have also added a whole heap of new contact fields, including identification numbers, and company number types for company contacts.

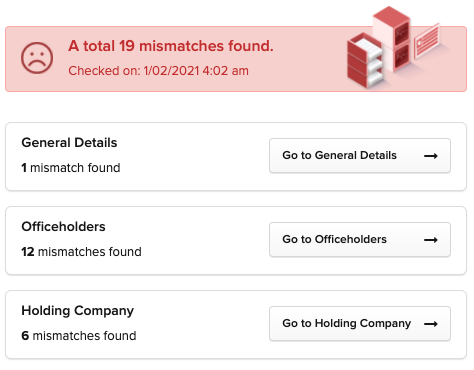

New Health Check for Company Details and Holding Company

For New Zealand Companies we have expanded the health check to now include General Company Details and Holding company information.

CAS 360 will now check this information every day with the NZ Companies Office and alert you if there have been any changes.

Live Checks (checking when inside the company) has also been added for Company Details and Holding Companies.

If you would like to view the full release notes for February 2021 please click here to visit the BGL Community.

See you next update!

Warren

Recent Comments