Published by selfmanagedsuper

Written by Jason Spits on 29 April 2020

The impact on the retirement income of superannuation fund members who choose to withdraw $10,000 from their fund in the current financial year under COVID-19 early access measures has been vastly overestimated by some models, according to an investments and retirement-focused fintech firm.

mSmart managing director Derek Condell said while the models put forward by ASIC and Industry Super Australia (ISA) are using figures presented in real dollar terms, they have also factored in inflation until the age of retirement, which in some cases could be up to 40 years away.

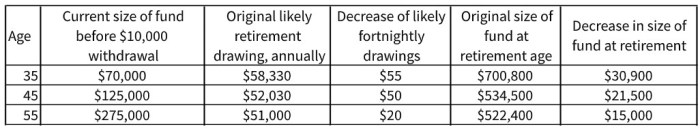

Condell said modelling conducted by mSmart, using algorithms developed by mSmart director Dr Frank Ashe and which eliminated the inflation component, found the overall decrease in a final super balance was around $30,000 for a super fund member aged 35 at the time of early access and who had an initial balance of $70,000 at that time.

He added the decrease translated to only a $55 a fortnight, or $1430 a year, drop in an original estimated pension drawdown of $58,000 and similar declines were seen for members currently aged 45 and 55 and retiring at age 67 and drawing a pension from age 68 onwards (see table below).

“We have calculated the above with a 50 per cent probability and assume that the investment portfolio is continually invested in assets despite markets having fallen from their highs, and the results are shown in today’s dollars, where we have taken inflation out to give a meaningful ‘like with like’ result,” he said.

“We have done this to show what purchasing power people would have with their superannuation if they were accessing the money today compared to what these funds may look like in 10, 20 or 30 years, and the impact is minimal.”

The firm’s numbers echo comments from a senior Treasury official who was questioned during a senate committee about the modelling used by ISA in producing its figures.

ISA released its model on 26 March and estimated fund members could face an impact on their final superannuation balance that was twice that estimated by ASIC on its Moneysmart webpage.

Responding to questioning from Senator James Paterson as to the difference in the figures, Treasury retirement income policy division head Robert Jeremenko told the the Senate Select Committee on COVID-19, which is examining the government’s response to the pandemic: “The major reason for that is the use of nominal figures rather than real figures. Those figures that ISA quote do not use today’s dollars, effectively.

“That is inconsistent with what ASIC has told super funds and what ASIC has told anyone who is making public statements about the effect on retirement balances of various withdrawals from super.

“So it makes intuitive sense to me that you use today’s dollars when you’re trying to estimate what effect a withdrawal will have at some point in the future, which is what the ASIC Moneysmart calculator does.”

mSmart recently announced it was in the final stages of developing an app that projects the likelihood of the future value of superannuation, savings pools and education funding plans, taking into account all the uncertainties of economies and markets.