Article written by Aaron Dunn, CEO & Co-founder of Smarter SMSF

The benefit of hindsight is a wonderful thing, in particular when it came to the way many practitioners dealt with the payment of income streams for their SMSF clients.

Before 1 July 2017, where a member was 60 years or over, it really didn’t matter how the benefit payments were paid as the pension was tax-free in the hands of the pension recipient and the fund had no reporting requirements around the benefit payments. Furthermore, based upon the benefits paid to one or more members during the year, the allocation of the payments that were been made could be considered as part of the fund’s annual compliance requirements. It was at that time a determination on the allocations between members and the various superannuation interests of members, in particular if there were varying degrees of tax-free proportions within the income streams were made.

Fast forward to today and the landscape has changed dramatically… Why? Well, the introduction of the transfer balance cap has put a much greater focus on how benefits may be taken, in particular where the amounts withdrawn exceed a member’s minimum pension for a financial year. It has been openly acknowledged that there is a ‘pecking order’ when dealing with benefit payments from 1 July 2017, in particular where the surviving beneficiary within a fund will end up with an excess transfer balance cap issue – see Smarter SMSF previous blogs, how well have you structured reversionary pensions under the super reforms and when is TBAR reporting due for a reversionary pension smsf for further information on the impact at death.

This order in taking benefit payments from 1 July 2017 is to:

- Meet the minimum pension – to ensure that the fund derives a level of earnings tax exemption on fund income supporting the pension

- Lump sums from any accumulation account – to subsequently maximise the level of earnings tax exemption by reducing the proportion of accumulation benefits in the fund as a percentage of the fund’s overall assets (accumulation and retirement phase); and

- Partial Commutations – to enable claw back of amounts against the credit balance on the member’s transfer balance

The sharper focus has arisen because amounts treated as pension payments do not count as a debit towards a member’s TBC, whereas commutations (in part or full do).

However, when considering the use of partial commutations as part of taking benefit payments during an income year, this benefit of hindsight no longer exists. This is two-fold, because of the:

- Commissioner’s views in TR 2013/5 and more recently, PCG 2017/5 regarding what is required for a commutation to be valid; and

- Transfer Balance Account Reporting (TBAR) requirements for the fund on either a quarterly or annual basis.

Therefore, to ensure that many of your SMSF clients correctly document and report these arrangements in a timely fashion, it is going to require a complete re-think and overhaul of your processes in documenting the annual pension decisions. For a range of clients (yes, you will need to undertake a some level of segmentation), you are no longer going to simply be able to document these decisions as part of the completion of the fund’s annual compliance, but rather start the documentation process in July each year to ensure compliance with the Commissioner’s views.

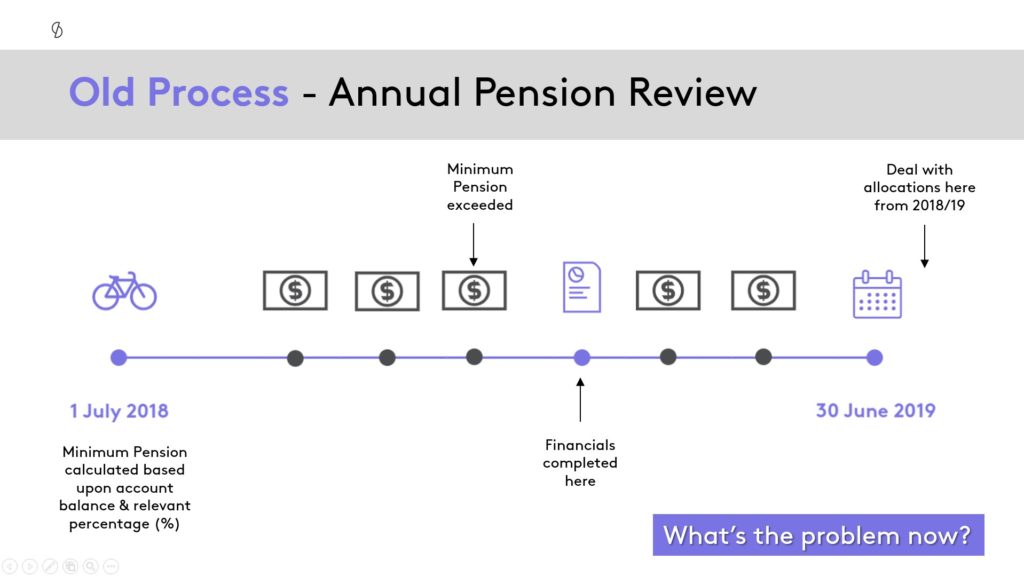

To understand the shift that needs to occur within a practice’s processes, let’s take a look at the following example:

Example – Annual Pension Amounts

Greg and Jill are trustees and members of their SMSF. Both had pre-existing income streams at 30 June 2017 with values of $1.2m each that we reported against their respective Transfer Balance Caps at 30 June 2017. During the current financial year, the level of benefit payments that they withdraw exceeds their combined minimum pension obligation for the year. However, at this time the financial statements have not yet been complete, so an accurate calculation of the minimum pension has not yet been determined.

Where the member wishes to treat the above minimum pension amounts as a commutation, rather than as pension, they can only do this prospectively. In the diagram below, this poses a problem as the member can not retrospectively document this decision on some of the withdrawals made. Furthermore, they may also be ‘out of time’ from a lodgement perspective of the commutation ‘event’ when reporting via a TBAR to the ATO.

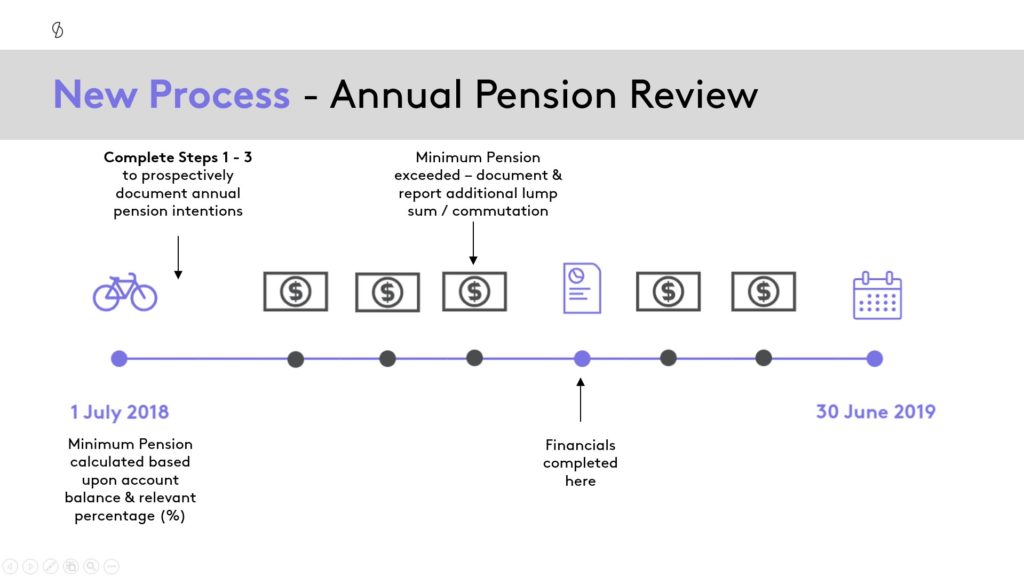

So, how to respond?

Giving consideration to the timing of the above, it means that practitioners need to be more acutely aware of (again, segmentation) of the clients that are taking more than the minimum pension and have a responsibility to report events quarterly. As a result, in my view, it now makes far more sense to engage with the relevant pension clients at the start of each financial year to get an indication of the expected benefit payments for the year. In this process, where the member(s) intends on taking more than the anticipated minimum pension, it will be important to have them initially document (by member request and trustee acceptance, following PCG 2017/5) their intention on taking commutations from one or more income streams, specifying where appropriate any priority in order of what income streams (where they have multiple pensions). This process is indicated in the diagram below:

It is important to note the dealing with how benefits will be taken, including commutations is contemplating financial product considerations. Therefore, your approach to dealing with this issue will be significantly different in a licensed vs. unlicensed capacity.

If you’d like to find out more about the Steps 1-3 in the slide images above, you can watch our recent webinar on the launch of our new Create Comply product, that provides a solution for unlicensed accountants around the common conversations you have with your SMSF clients. We look forward to rolling out a process, where these letters can be produced across all clients automatically connected via Simple Fund 360.